Making good decisions and sticking with them for a long time is a recipe for investment success.

Short-term indicators discussed in this email may create an illusion that timing the market is simple.

It is not. Anything can happen in the stock market.

Markets will take from the impatient and give to the patient.

The NASDAQ index, which was (and is) heavily weighted towards technology, dropped 80% from 2000 to 2003. Cisco, a company that provided the hardware to help build the Internet, was one of the biggest beneficiaries. Its stock went through the roof, and then it collapsed. Despite making hundreds of billions of dollars over the last 20 years, it has never recovered. Sometimes buying a good company is not enough. One has to think about the price and the risk. The Internet transformed the world, and it has never been the same. This didn’t make the companies immune from reality. This explains my view of our current tech bubble and Wall Street’s obsession with Artificial Intelligence.

The Bounce

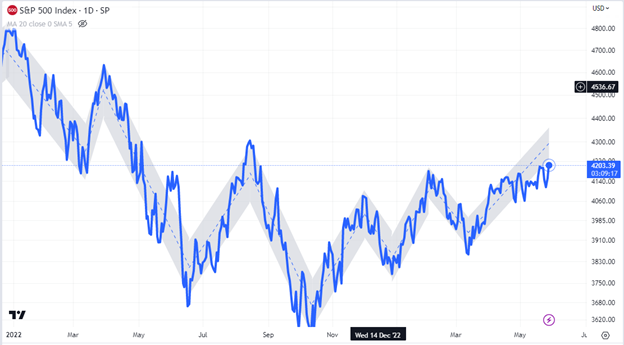

Last week, I wrote that if this market is going to continue higher, other sectors should join. This has yet to happen—the S&P 500 is where it was a week ago. The NASDAQ is up big, and the Dow is down big. Also down in the last week: small company stocks and just about every sector. This is a tech-only rally, and it has been excruciating for everything else.

I considered buying into the market based on the powerful momentum. (My indicators do not signal a buy.) The challenge to buying technology now is that the risks are high. We are still determining if we are in a situation like December of 1999 with another month to go or if we are already in January of 2000 and the top is coming any day. What we do know is that the Fed is actively trying to slow this economy and drain money from the financial system. That is much more like 2000 (Fed raising rates) than 1999 (Fed not raising rates).

What all this means is patience.

Consumer Spending and Inflation Come in Hot

Consumer spending continues to be resilient, and inflation has been as well. This morning, PCE inflation, the Fed’s “preferred inflation gauge,” came out.

- Consumer spending is up 0.8% (0.4% expected)

- Auto sales are up 10% despite the average auto loan at a 10% interest rate (amazing)

- PCE inflation rose 4.4% (3.9% expected)

- Core PCE rose 4.7% (4.6% expected), the first increase since October!

- There is now a 70% chance the Fed will hike 2 more times this summer. Just two weeks ago, zero hikes were expected this year. Today’s PCE inflation is a significant setback for the Fed.

Stock and Bond Markets

Stocks: Momentum is with technology. Contrarian indicators show a weak market that is ready to turn lower any day (same as a week ago). When that day finally comes, the hottest sectors are likely to lose the most. Adding to them now seems like a high-risk gamble. The bond market is exactly the opposite. Bonds look like an okay value. I do not want to add money to bonds if they fall. We need positive momentum or an extremely oversold situation to add. We are not close to either.

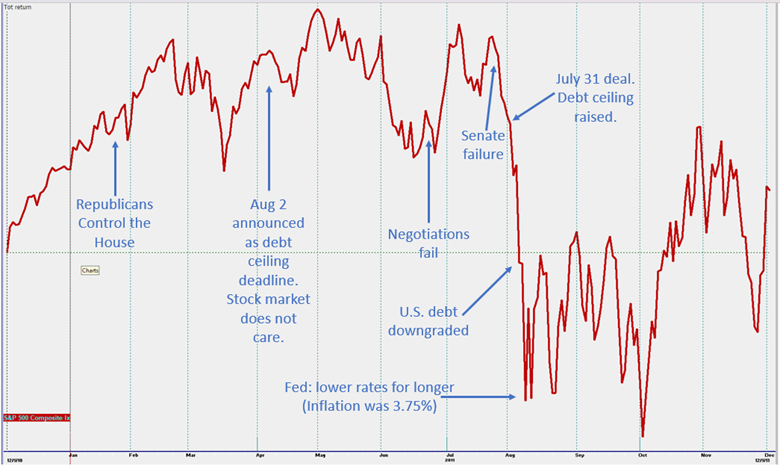

Debt Ceiling

The market simply does not care at all. It never panicked on bad news and never rallied on good news. This surprised me. The impact rests on a few questions:

- Will the negotiated agreement pass on the first try? If so, extremists will have to cooperate, or moderates from both sides will have to agree.

- What drove markets down in 2011? Was it the political crisis or the change in financial liquidity?

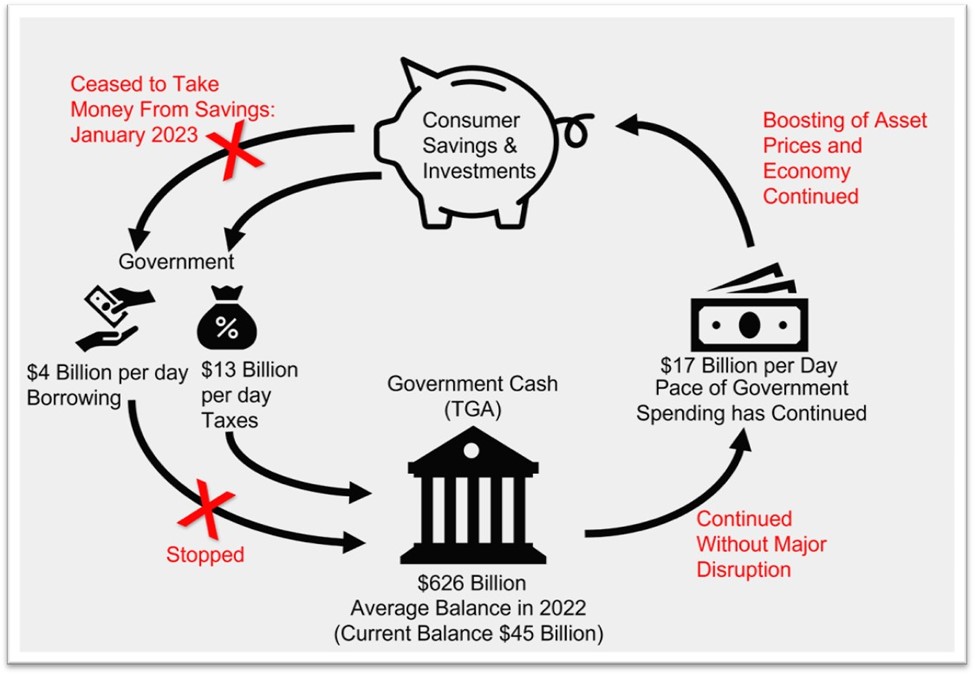

In 2011, the debt ceiling vote came just before the deadline, and stocks collapsed anyway. What if the cause was not the crisis but the issuance of new government debt? This would explain the resilience (before the deadline) and the drop (after the deadline).

The Treasury needs to get its account back to normal with a massive amount of new borrowing. The money will come from global savings, including investments in stocks and bonds, which may put downward pressure on prices. We will see.

What we know so far: On June 1st, the Treasury Department plans to issue $64 billion in new debt. (The Fed’s quantitative tightening is $95 billion a month, so $64 billion in one day could have a major impact.) After the first couple weeks, I expect the Treasury to have above-average debt issuance for the next six months.

Market Outlook

Short-term bonds have been a good place to get paid to wait. Long-term bonds also look attractive, and I believe the positive reward is yet to come.

Reasons the market could keep going up:

- Stocks rise over the long term.

- Momentum is powerful.

- Consumers are willing to take on debt to keep spending.

- Strong employment (record low at 3.4%).

- Endless possibility of Artificial intelligence.

Headwinds for the stock market

- Slowing momentum that relies on fewer and fewer companies.

- Consumers in debt. (Housing debt looks fine. This is not 2008.)

- Sticky inflation and a Fed that continues raising rates.

- Fed estimates it takes 18 months for the full impact of rate hikes.

Cisco helped build the Internet, and there were endless possibilities in 2000. That didn’t make it immune from reality.

Sources:

https://fred.stlouisfed.org/series/D2WLTGAL

https://www.bloomberg.com/news/articles/2023-05-19/what-is-the-debt-ceiling-how-to-protect-your-money?sref=0UW4o8YY

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.