Another bank failed on Friday: First Republic Bank. This is the 5th major bank failure in the last two months. The government has essentially guaranteed that depositors will continue to get all their money back. Their objective is to limit the economic impact of panic. This is important, but it is just a Band-Aid. Money will continue to leave banks.

The real problem with banks is that they received massive inflows over the last ten years when interest rates were at historical lows. In 2020, when the government was giving away money, the Federal Reserve rate was zero. Banks took the deposits and invested in low yields. They also gave loans, especially mortgages—also at record low levels. Banks locked in low rates.

Thanks to inflation, interest rates are much higher in 2023. Most Americans have no obligation to keep large sums at their bank. Why not look around? They might find a rate ten times better without taking much risk. This is why the money will continue to flow out of banks and into other financial institutions. (The Wealth Advisors at SFS have helped many clients with this same goal.)

I want to emphasize that so far, the government is protecting deposits. The Fed even has an asset program to help banks with liquidity when people withdraw large sums. None of these changes the differential in interest rates, so banks will continue to struggle.

Education Section

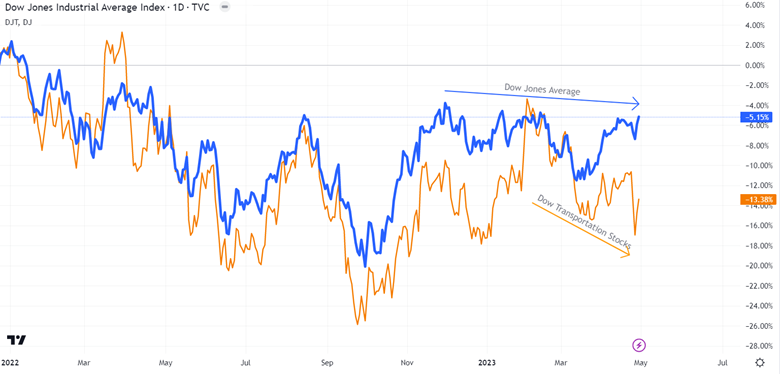

Dow Theory is a 91-year-old market indicator. It recognizes that investors can push stocks higher even when they should be falling. That is a dangerous time to buy because things could turn any day. To cut through the noise of financial markets, Dow Theory compares the Dow Jones Stock Average with the Dow Jones Transportation Average. If the economy is doing fine, then transportation companies should be doing well. Something is wrong if some stocks are doing well but transportation is not.

Where Are We Headed?

Last week, we learned that the economy is growing at 1.1%, and inflation is still around 5%. This week, we will find out if the Fed will raise rates again and their expected path for interest rates in the coming months.

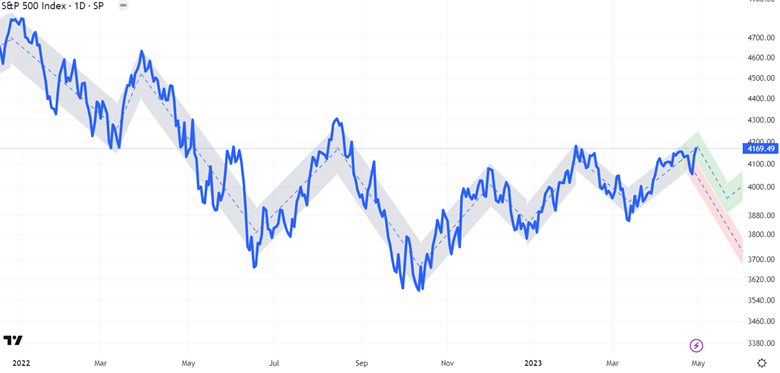

Stocks and bonds are bouncing all around without decisive direction. The facts are that the economy is slowing, but we are not in a recession. The job market is worsening, but unemployment is still near historic lows. Profit growth for S&P 500 companies is negative but better than the expected -7% for the period ended March 31st. We are getting closer to entering the most anticipated recession ever, but we are not there yet.

The S&P 500 has barely moved up in the last month. This will not last. There is always the possibility of a final squeeze higher. This would make it difficult for short-term traders to determine where markets are headed. By the third week of May, I expect we will be lower. Perhaps low enough that stocks are attractive. We will see. Anything could happen. That is what makes timing so difficult and why long-term investing is so smart. Regardless, I continue to recommend adding short-term bonds to portfolios. They are a great place to get paid to wait.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.