Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

The Only Constant in Life Is Change

—Heraclitus

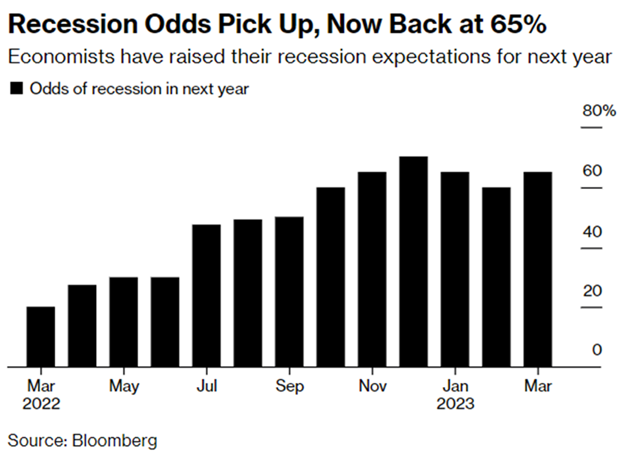

Many investors have embraced a “glass is half full” attitude about the economy and markets. They will be the most surprised when the status quo ends. Today, I explain why a recession is a near certainty and is not priced into the markets. (I will explain in simple terms what that means.) Finally, I share the best place to stay invested during the storm.

What is happening in the Economy?

- Consumer demand is going crazy. It has been this way for a couple of years. Corporations are aware, and many are taking advantage. They are raising prices even when it means lower volume. The net result has been positive (for them). Americans did cut spending in March by 1%, but the amount was still $1.2 billion more than in March of 2022.

- Unemployment is near all-time lows. The rate is 3.5%, and it doesn’t get much better than that. Weekly jobless claims are rising but are still below 250,000. That is an old benchmark of mine that raises a red flag.

- Home prices and builders are somehow hanging in there despite higher mortgage rates. New housing permits are down 16% from a year ago. At one point, they were down 27%—a marginal improvement. This industry is skating on thin ice at no fault of its own.

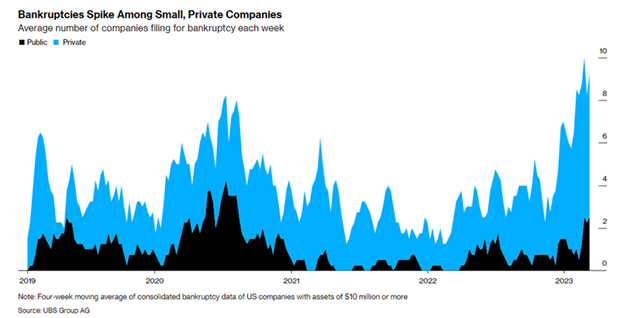

- Last week, we learned that David’s Bridal is declaring bankruptcy and closing all stores. They are not alone. A major Burger King franchise is closing 116 stores. Bed Bath and Beyond may finally go under as well. Nationwide, bankruptcies have been occurring at the fastest pace since 2009.

How are investors behaving?

Everyone is aware that there are risks in the economy, but how are they actually behaving? Last week, we discussed investor sentiment in detail. The average investor has made very few changes to their portfolios. The National Association of Active Investment Managers reported that stock exposure continues to move higher. The current allocation is over 80% and approximately the same level as it was when stocks rolled over in March 2022, August 2022, and February 2023. Stocks are not priced low enough for a recession.

Have we already seen the worst?

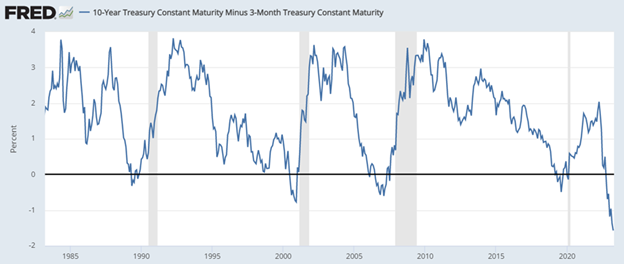

A recession is coming. I see the probability at 99%. I could cite all kinds of data. The yield curve is sufficient evidence today. It is always early in signaling a recession. It has never been wrong. First, it goes below zero. Then, it returns to positive. That is when the recessions began (grey-shaded areas). In the last 20 years, a recession has always followed.

The real question is timing. According to Bloomberg, the probability of a recession in the next 12 months is 65%. If inflation stays high and the Federal Reserve continues to raise rates, the yield curve stays inverted, and the recession is delayed further. Consider the possibility that the Fed could keep raising rates as long as the unemployment rate is below 4%.

For the path forward, I will make one assumption: The yield curve must un-invert. It is only a matter of time. That means (1) long-term rates rise or (2) short-term rates fall.

(1) The yield curve could return to normal if long-term rates rise. That would require a 1.5% increase in the 10-year rate, assuming short-term rates are steady. Long-term bond prices would get crushed again in this scenario. Then, imagine the pain in the economy if mortgage rates reached 8%. The slowdown would accelerate, or prices would come down, or both.

(2) A drop in short-term rates with long-term holding steady could un-invert the yield curve. The Fed has repeatedly said it will not lower short-term rates this year. So, this would occur only with an immediate and severe drop into recession. Long-term bonds would typically be a good place to be in this scenario. That’s why they moved up already. Even if it occurs now, there is less money to be made. It is priced in. Stocks did not move toward economic collapse. So, they could still fall into such a scenario.

Stock and bond markets are not currently moving toward either of these scenarios. Change is coming. The yield curve will return to normal. Take another look at the graph. There is no way it is all “priced into the markets.”

Education Section: What Does “Priced In” Really Mean and Why Should We Care?

Last week, Tesla announced it was lowering the price of its cars again. Unlike other auto companies, Tesla often adjusts based on manufacturing costs and consumer demand. The price on some of the less popular models is down more than 20% in just the last six months. Conventional wisdom tells buyers to wait. Most would wait if buyers knew that they could get the exact new vehicle for $60,000 today or $50,000 in a month. This is the danger of expectations and deflation. If all goods were that way, consumer spending would really fall.

Market wisdom tells buyers to act now to get a lower price. I know what you are thinking, “We cannot get the lower price yet.” In financial markets, prices move based on expectations. If investors believe prices will come down in three months because of slowing demand, then they will begin falling now. Expectations are what drive changes.

The best example in financial markets is in bond yields. Every bond has a different duration, and they expire. The Fed rate is an overnight rate (annualized as if it were for a year). It is currently 5.0%. A year ago, it was 0.5%. (Yes, you read that correctly.) And when yields rise, existing bond prices fall. No wonder some banks went bankrupt last month. They were not prepared.

Short-term bonds can be for 3, 6, or 12 months. Long-term bonds can be for 10 or 20 years. (In 2017, Argentina sold 100-year bonds.) Each has a unique interest rate depending on the time when it was issued, the expected inflation rate now, and the current demand in the markets. Essentially, prices work like the car example above.

Here are three hypothetical outcomes for interest rates:

(1) If the Fed raises its overnight rate from 5% to 5.5% over the next six months, then the yield on a 6-month bond should be around 5.5%.

(2) If I thought a recession was coming and the Fed would instead lower rates to 4.5%, then I expect to find that 6-month bond paying much lower than 4.5%.

If investors expect scenario one (rising rates) but get scenario two (falling rates), then the value of government bonds should rise. The reality is just the opposite. Markets have priced in a lowering of rates by the Fed. The Fed may continue raising rates. We don’t know. What we do know is what its members are saying. They tell us they will not be lowering rates this year. If true, the bond market needs to adjust. The longer the duration, the bigger the adjustment.

Where Are We Headed?

I laid out two paths for the yield curve to return to positive. Neither one is great for long-term bonds. For stocks, they are probably not good either. The investment that looks favorable, in my opinion, is short-term bonds. They should be okay if long-term rates rise and would be great if short-term rates fall. We will see if this turns out to be true.

Stocks could find a way to surprise for another week. I see little potential. My outlook has stocks moving lower. I am showing 2021, 2022, and 2023. This perspective reminds us of what a bull market looks like. If I had shown a full ten years, we would see just how insignificant the current bear market has been.

Long-term investing means hanging in there. That is where the greatest rewards are likely to be achieved.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.