Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

“Be fearful when others are greedy and greedy when others are fearful.”

—Warren Buffett

Our economic challenges are moving from inflation to a slowing economy. Last week, we learned that consumer spending fell more than twice as much as expected. Apple, for example, reported that its computer sales are down 40%. One might expect government bonds to rise and stock values to fall. This is the opposite of what happened.

I think the stock market looks a lot like August 2022. For now, it is holding up. We can thank central banks like China for injecting massive amounts of money into the global financial system. Individual investors are also helping by holding on. Is it complacency or greed? We explore this question in the next section.

Education Section: Put Your Money Where Your Mouth Is

I track changes in investor mood. It is one of my key indicators. The important thing to know is that how we feel about investing often leads us to make incorrect decisions. This is contrary to other things in life, where our feelings can indicate right and wrong.

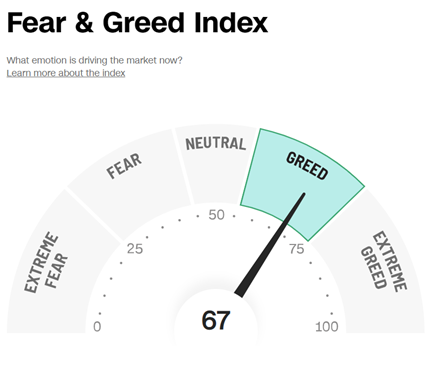

The Fear & Greed indicator is the most volatile (and the least helpful for decision-making) of the sentiment indicators I track. It is based on actual market movements in various assets. It has been steadily rising recently and shows that current market action does qualify as greed.

The American Association of Individual Investors asks its members how they feel about stocks each week. Just before the market peaked in January 2022, only 32% felt bullish. Their allocation did not match their sentiment. They had 71% of their money in stocks. Throughout the year, the bullish number bounced around but never made it higher than 33%, which is exactly where it was at the beginning of April 2023. What about their allocation to stocks? They lowered it to 69%.

I interpret this as complacency. For 15 years, low inflation and endless bailouts by the Federal Reserve have created this attitude. A resilient economy and excess savings have meant few investors have been forced to sell. (Timing the market is incredibly difficult, so these investors should be commended for keeping a long-term perspective. Still, I am surprised. My experience in bear markets is that they don’t end until investors capitulate.)

Professionals tell a different story. The National Association of Active Investment Managers swings wildly from week to week. In January 2022, when the bear market started, their average allocation to stocks was 90%. That’s really high. It dropped as low as 12% last year. In February of 2023, they were back up to 83% in stocks. The market has a way of always punishing this group. They always seem to be one step behind. (I have written about this indicator in detail twice over the last six months.)

How has this impacted investors? According to Yahoo and VandaTrack, the average investor has lost 27% of their money (including the recent bounce in markets). Those who stick with it should be fine over the next ten years. However, I prefer a more active approach. The challenge is knowing when to put your foot on the gas and when to tap the brakes.

What Happened Last Week?

Last week, I wrote about the impact that even a small change in consumer spending could have on the U.S. economy. “We are at a critical juncture. We are no longer just fighting inflation. Economic pain can now be seen in the numbers. From banks to consumers, it is clear that a slowdown has begun.”

Evidence of this drop in consumers came on Friday when national retail sales surprised investors. A drop of 0.4% compared to February was expected. It was much worse. Consumer spending fell by 1.2%. This is not severe enough to cause a recession, and it is still a slight increase from one year ago. It also can be volatile. Rising or falling based on things like bad weather.

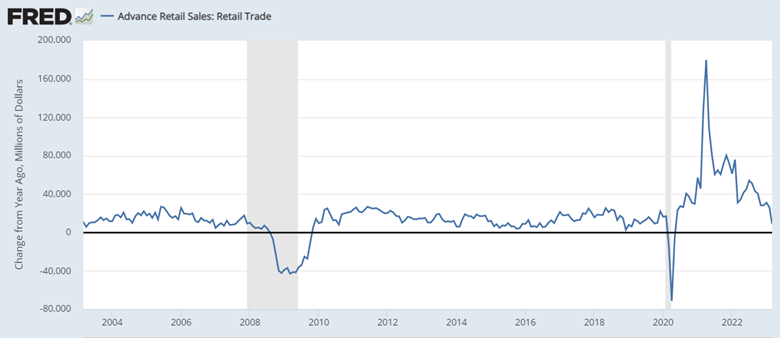

The chart offers perspective. I am showing a 20-year chart that focuses on the change from 12 months ago because I think it illustrates the trend best. Allow me to highlight a few things:

- Retail sales peaked in April 2021.

- Spending dropped in March 2023 compared to February 2023 (falling line).

- Consumers still spent more in March 2023 than in March 2022 (still above zero).

- Further declines would be serious.

In our personal economies, a decline in spending can be good if we are not forced to do it. Choosing to decrease our spending means we are saving more. It improves our finances. At a national level, we don’t typically see consumers start saving out of choice. Shopping seems to be as American as apple pie. We cut back in aggregate only when forced.

Where Are We Headed?

A sign of slowing in the economy should generally be positive for government bonds and negative for stocks. Last week, we had a slowing of consumer spending and a slight rise in new claims of unemployment. Both of these were worse than expected. However, markets did the opposite of conventional thinking. Stock values rose (barely), and long-term bond prices fell.

Little has changed in my market outlook. I anticipated the possibility that stocks could rise in March. However, I saw an April decline as probable. So far, I have been wrong, but not by much. Stocks have found a way to hold on and could make it a couple more weeks. Anything can happen, so we don’t want to run away from all risk. However, the Dow is already extremely overbought. If markets follow the green path, then I would expect almost all my indicators would flash warning signs. Instead of loading up on risk now, I am attracted to the higher yields on short-term bonds. They have not been this good since 2007.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.