Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

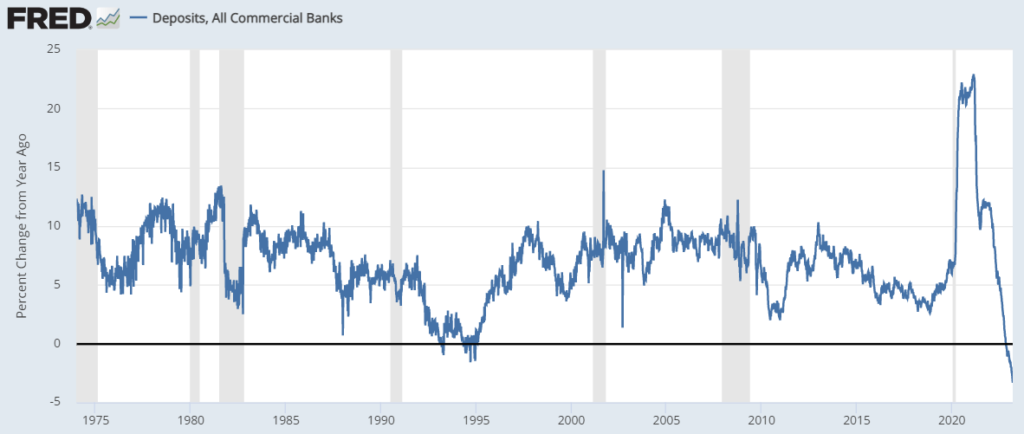

We are living through a time of modern, electronic bank runs. They are extreme in their size and percentages due to excess government intervention over the last 15 years. With seemingly unlimited guarantees needed and with inflation still elevated, U.S. government officials are unsure how to intervene further.

On October 24, 1929, the Dow Jones Industrial Average dropped a devastating 25%. This became known as Black Thursday, and it is widely considered to be the unofficial start of the Great Depression. From that moment to the middle of 1933, over 9,000 U.S. banks failed. (To put that in perspective, just over 160 failed in the 2008-2009 recession.) In addition to all the other problems facing the nation, there was a lack of confidence in banks. No bank could survive excessive withdrawals when panic struck.

President Franklin D. Roosevelt signed the FDIC into law with the Banking Act of 1933 and later modified it in the Glass-Steagall Act. It acted as an insurance program. Banks would pay approximately 8 cents for every $100 deposited to get U.S. Government protection on deposits lost. The original banks believed it was too expensive, but it has proven its worth. Overtime, the amount insured has increased:

- $5,000 (1934)

- $10,000 (1950)

- $15,000 (1966)

- $40,000 (1974)

- $100,000 (1980)

- $250,000 (2008)

- No Limit? (2023)

Silicon Valley Bank (SVB) and Signature Bank failed earlier this month when an electronic bank run occurred. Nearly all SVB assets (97%) were beyond the $250k limit. One company had around $3.3 billion in deposits. Yeah, that is a lot more than $250k!

Banks almost always fail on Fridays. This gives regulators the weekend to figure things out. They have three options.

- The best option for the government is to find a buyer—another bank to take over the failed one. All accounts and loans are automatically transferred to the new bank. It’s a clean option. This took place just last week when UBS bought Credit Suisse. (To get the deal done, the Swiss government had to agree to take on any losses above a specific threshold.)

- If no buyer emerges, the next best scenario is auctioning off pieces of the company. This may be how our current banks get sold. However, we are still waiting.

- The last option is for the government to take over. The FDIC makes all deposits up to the legal limit available immediately. It then gradually sells the assets to get that money back, as well as other deposits.

It seems Janet Yellen has struggled with the concept of “no limit” insurance. She probably should. It has never been done before. When she fears nationwide panic, she says it will be available. Within a few days, she rescinded that idea. I believe she has gone back and forth on the issue a few times this month. Clearly, it is a question of confidence versus a moral dilemma. The lesson of 2008 for government officials was that if you are going to go big, then go big early to prevent a crisis.

Where Are We Headed?

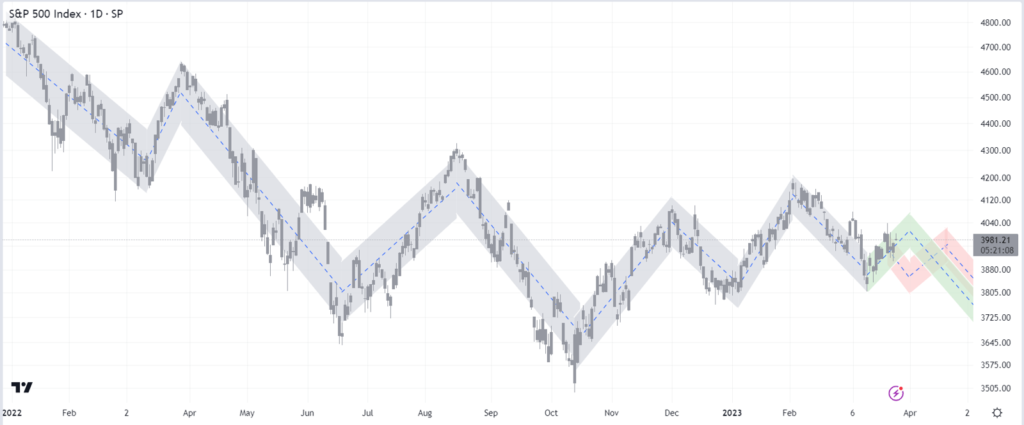

Last week, I suggested that the stock market may have a big move that would take it outside of my path but then abruptly come back. That is exactly what happened. The market moved beyond my green path. Then the Federal Reserve raised interest rates. Markets fell back into the trend.

While I see the potential for the market to continue on a path similar to my green one, I don’t expect much. We are dealing with a confluence of negative factors right now: high inflation, rising interest rates, a possible bank crisis developing, falling home values, and dropping consumer strength. At some point, I believe the seriousness of the situation will become evident in the markets. Warren Buffett has said that the stock market is the only place where people run for the exits when things go on sale. With that in mind, I continue to believe that an incredible buying opportunity is coming this year. I also believe that moving in too early will be extremely painful. Patience will be crucial. As always, I will be watching for any indication that something else is happening. Markets always find a way to surprise.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.