Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

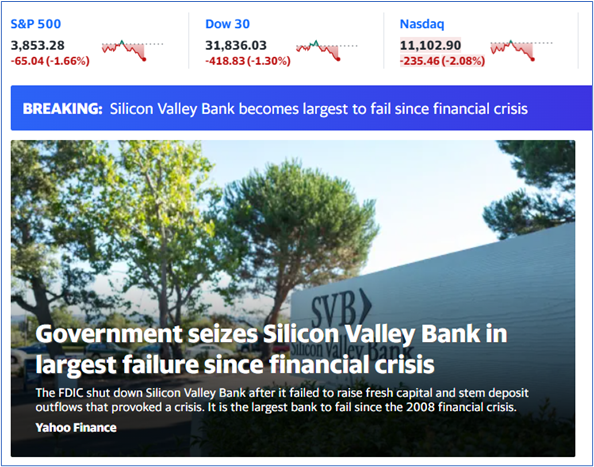

Last weekend, I wrote that the Fed was forcing the economic tide out, but no major company had been caught swimming naked. That all changed on Friday with a bank failure. We have a new question:

What If There Is a Crisis Before Inflation Comes Down?

This is exactly what happened in 2008, and it places the Federal Reserve (Fed) in a tough spot. We are living in a new normal—one with strong employment, greater inflation, and higher interest rates. This places a strain on many companies, especially banks.

The FDIC is currently shutting down Silicon Valley Bank (SVB). SVB is the second largest bank to ever fail ($211 billion in assets), and its stock is in the S&P 500 index. SVB funds tech startups and helps tech executives with their financial needs. It had two problems:

- Asset Management

- Deposit Vulnerability

Deposits at SVB grew wildly over the last few years. It took those short-term deposits and invested them in intermediate-term bonds. There is a mismatch that cost them dearly when rates began to rise. JP Morgan reports that around 97% of deposits were above the $250 thousand FDIC limit, and 86% were above the $25 million maximum limit. Then came an old-fashion bank run. According to Bloomberg, withdrawals totaling more than $40 billion came last week. SVB could not come up with that much cash, and it became insolvent.

The Fed and the Treasury Department announced they will cover all deposits. This is meant to stop a run on all U.S. banks. They have also created a one-year window where banks can exchange bonds for cash. This should prevent a crisis. However, there is a line in the sand. Shareholders of the banks are not protected.

How will bank failures and government action impact the broader economy and the stock market? That is the most important question for us. Inflation has been coming down slowly, too slowly. It will likely continue that path. Right or wrong, the Fed will probably continue its fight against inflation, but with greater patience. It will try to thread the needle: lower inflation without slowing the economy. As I pointed out last week, I don’t think it will succeed with both.

Education: Are We About to Repeat the 2008 Crisis?

I do not believe we are about to repeat 2008, but I think it offers some lessons. We remember 2008 as a housing crisis because that was the sector caught when the economy slowed; this is only part of the story. Like our current situation, 2008 was a tug-of-war, with inflation rising on one side and a slowing economy on the other. Despite all the struggles in 2007 and early 2008, inflation continued moving higher, and it continued until the real crisis began in August.

The first notable company to collapse in 2008 was Bear Stearns. (This is a good comparison with our current situation with SVB because it was also a case of insolvency). At its peak in January 2007, Bear Stearns’s stock traded for over $171 per share. By March 2008, JP Morgan purchased the failing company for $2 a share (and that included a government guarantee on $30 billion in assets—making this a deal CEO Jamie Dimon could not refuse).

The largest bank to ever fail (and the only one larger than SVB) was Washington Mutual. In desperation, it sold itself to JP Morgan in September 2008. (These closures usually happen on Fridays because it gives everyone involved a weekend to sort out the mess.)

The Bankruptcy of Lehman Brothers

The quintessential moment of the Great Recession of 2008 was the collapse of Lehman Brothers. Lehman was a financial services company. It had assets of $680 billion, but only $22.5 billion was backed by the firm’s capital. The difference was all borrowed money. (That was a lot of debt). A decline of even 5% would wipe out the company. That is exactly what happened. JP Morgan did not buy Lehman. However, there was an offer. On Saturday, September 13, 2008, a late emergency meeting was held with all the investment bank CEOs at the N.Y. Fed building. After hearing of Lehman’s dire situation, the CEO of JP Morgan, Jamie Dimon, famously offered what he said the company was worth. He pulled a $1 bill from his pocket and set it on the table. No one else stepped forward with any offer.

On Monday, everything seemed to collapse. The U.S. Government began working on the Troubles Asset Relief Program (TARP), as well as nearly a trillion dollars in bailout money for banks. To avoid the stigma of taking the money, all banks were forced to accept it. Soon other American companies facing bankruptcy were given access to funds, including General Motors.

How Did the Inflation Battle End in 2008?

The Federal Reserve had been slowly raising rates to bring inflation down in 2008. Inflation stayed stubbornly high even as company after company failed. Given the delay in CPI data, the most recent number released at the time Lehman went under would have been July’s 5.5%. The Fed had to balance the tightening with failing companies. When Lehman hit, everything changed. That stubborn inflation dropped to zero in a few months. That gave the Fed the freedom to lower rates and do whatever it could to boost the economy. The age of Modern Monetary Theory was born. The U.S. Government had not been this involved in the economy since the Great Depression. And it continued offering more and more stimulus until 2022.

I am not a banking expert, but in my humble opinion, SVB is not the Lehman moment of 2023. First, a buyer may emerge. Second, we have different problems than we had in 2008. Here are some major differences:

- Banks are better capitalized (required by Dodd-Frank Act, which became law in 2010).

- Lending standards have been better for mortgages.

- Homeowners have significantly more equity.

- There is a housing shortage, according to most experts.

I believe it is better to view our current situation as a warning. If banks, corporations, and consumers heed the warning, then inflation may turn lower, and the Fed does not have to keep tightening. If not, then the Fed will be forced to continue higher in the battle against inflation, and we will see more failures.

Where Are We Headed?

Our current market is starting to look like the inflation fight of 1973 combined with the tech bubble of 2001 and the banking crisis of 2008. If you didn’t see my graphs last week, click here to view them. While I see some similarities with past markets, so far, it has not been as bad as any of those. I believe the main reason is that consumers, on average, began this process with more money than in past recessions. The stock markets’ reactions to the bank news have been relatively positive. This was not a panic. My graph lays out two paths. Be careful with this because anything could happen. I have an entire set of indicators that have nothing to do with this charting. I still like the graph, though. I find it gives me perspective as long as I remember that the markets have a way of surprising.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.