Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

“Only when the tide goes out do you discover who’s been swimming naked.”—Warren Buffett

The Economic Tide Is Going Out, But Is Anyone Swimming Naked?

When my wife and I were first married, we lived in the basement of my grandparents’ home. It was an incredible blessing that helped us save enough money to put 15% down on a home. The lender asked for 12 months of pay stubs and bank and credit card statements to get approved. We did all this on a copy machine and delivered them in person. I don’t know how typical this was, but the process is vastly different now.

Sometime in the early 2000s, the mortgage industry loosened lending standards to help people deal with the rising cost of home ownership. Financing banks overlooked red flags because they were bundling these mortgages into securities that could be sold to investors in the markets, similar to stocks and bonds. Few understood that the risks were not isolated to a few overpriced cities. The risks were systemic.

In 2005, a modest inflation rate of 4% led the Fed to slowly raise interest rates. The tide slowly moved out, and that systemic risk was revealed. In fact, it became shockingly obvious. The negative effects spread to the banking system and cascaded through the entire economy, and it was devastating.

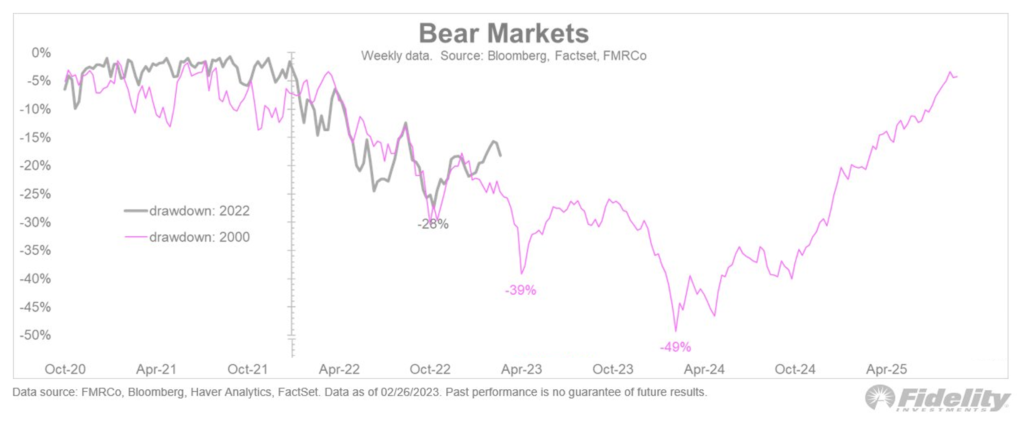

As the economic tide started moving out in 2022, we saw a few high-profile companies fail. The good news is that we have not yet seen any large sectors of the U.S. economy swimming naked. Everything seems orderly—more like 2002 than 2008. The stock market is clear. We are following a new path with some similarities to the past.

Education: Critical Points and the Yield Curve Indicator

Last week, I wrote about the stages of the economic cycle—including the tricky ones in the middle where everyone feels that things are going to be okay, only to be disappointed. This week, I want to tackle a different dilemma: Why must we hit every stage of the economic cycle? In other words, Why can’t we bring inflation down without causing a recession?

Getting inflation down in a strong economy is a critical point.

- Imagine a stable critical point attached to the hose of a vacuum. As you get closer to it, it pulls you in.

- An unstable point becomes more difficult to reach as you get closer. I like to compare it to a coin flip. Heads, we get inflation. Tails, we get a recession. The Fed is flipping the coin a little harder every six weeks to see if it can get that coin to stand on its edge.

Is it really this difficult? I’ll let you be the judge with the help of these news clippings. Each recession over the last 50 years was preceded by talk of a “soft landing.” I will concede that some were “softer” than others—those that did not have systemic problems where entire sectors of the economy were swimming naked.

Where Are We Headed?

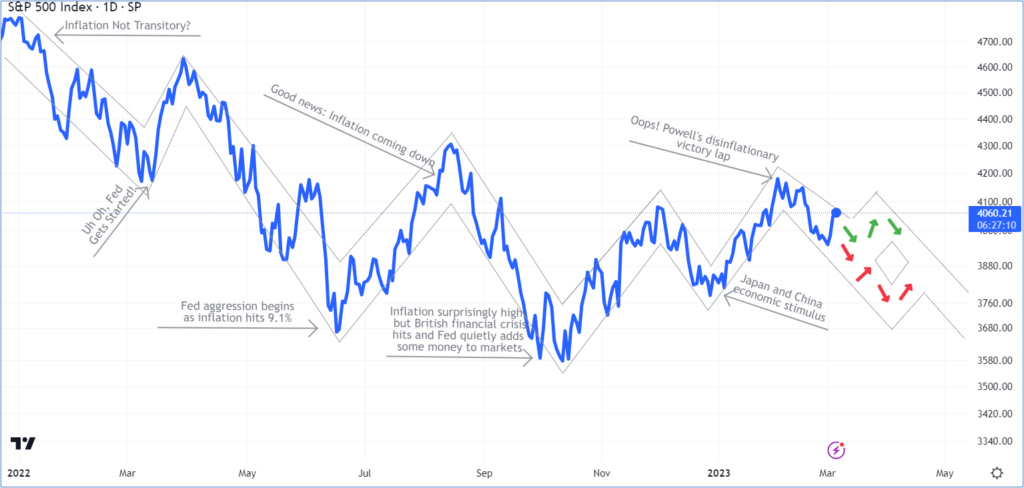

The market behaved in line with my expectations. Stocks moved to the bottom of my channel and then, in just two days, reached the top. It is similar to what we saw in 2022. Going forward, I have divided the path into two. Given the stubborn global inflation, neither the red nor the green have stocks reaching a new high soon. As always, these are educated guesses.

As always, remember that predicting the market accurately is nearly impossible. Anything could happen. It is possible for stocks to move outside of the lines I have drawn. The best investors will decide how much risk they are willing to take at any given time. For me, that risk level is relatively low right now. I look forward to the day that I change my mind. I believe that the American economy is resilient, and there will be plenty of opportunities this year and for years to come.

Circling back to Warren Buffett, he gave us an update last week. He has $89 billion in cash. He is looking for great companies to buy at bargain prices. That’s why they call him the Oracle of Omaha. His incredible patience is manifest as he waits. His bold optimism when he eventually buys.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.

One Comment