Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

Fed Wars

Markets are continuously moving based on money flows in financial markets, investor sentiment (fear and hope), and speculation on the future. In recent weeks, I have commented on the first two. Today, we return to the business cycle. Why is it our destiny to continue through its stages, and what clues does it offer investors for the future?

The answers can be found in our current economic cycle. Pay close attention to stages IV and V. This is where we have just left and where we are headed, respectively. In addition, they are not typically included in a textbook description of the economic cycle as they are only transitory stages.

(I may criticize the Fed occasionally, but overall, it helps provide financial stability. The Fed has a challenging job, which sometimes leads to mistakes with massive consequences. I also hope Star Wars fans and non-fans alike will forgive me for having a little fun with this deeply serious economic situation.)

Stage I: Phantom Money (2020)

The pandemic engulfed the world economy, and liquidity dried up in financial markets. While politicians endlessly debated an alarming chain of events, Federal Reserve Chairman Jerome Powell was dispatched to increase trade in the U.S. economy.

The Fed created nearly $5 trillion almost magically and inserted it into the financial system by purchasing government bonds and government-backed mortgage bonds. This had little impact on the economy at first but immediately pushed up investment prices. By taking away “safer” investments, Powell pressed other participants to take more risk. Powell then lowered interest to near zero. This had an indirect impact on all other rates. Mortgage rates for the average 30-year fixed rate reached their lowest level in U.S. history: 2.65%. Americans, many stuck at home, started investing and spending.

Stage II: Attack of the Costs (2021)

There was economic unrest in 2021. Thousands of goods were in short supply. Prices were rising. Under the leadership of Jerome Powell, Americans were told that inflation was “transitory,” but it was mysteriously consistent and was becoming difficult to ignore. Used car prices rose over 40%. What about home values? Looking at the change from just before the pandemic began in 2020 to their peak in 2022, homes increased nationwide by around 45%. Financial order had to be restored before Americans began to consider price increases the new normal.

Stage III: Revenge of the Fed (2022)

War on inflation began. In a series of stunning moves, the Fed tried to bring down demand by raising interest rates at the fastest pace in U.S. history. Fear of a slowdown swept through markets. Bonds had one of their worst years while inflation continued to besiege the economy. The average mortgage rate moved up to over 7%, crushing the number of homes sold by -20%. Somehow, the median American home still managed to increase in value. Affordability had never been worse.

Stage IV: A New Hope for Pivot (2022-2023)

Conflict in economic outlooks began. The Fed’s effort to tame inflation appeared to be working, with American unemployment at its lowest level since 1969. A new hope emerged. The Fed would win this battle, and a soft landing would be achieved. Stocks and bonds rose. Mortgage rates dropped to around 6%, giving a little life to the housing market. Never underestimate hope. Even Jerome Powell appeared to take a victory lap in his two February speeches. It was not to be. Pursued by endless consumer demand and fueled by savings and debt, Americans continued to spend. Prices continued to rise.

Stage V: The Economy Strikes Back (2023)

Jerome Powell has discovered sticky inflation just in time. The hope of a Fed pivot has been shattered for now. At the same time, the Fed is trying to slow things down. Banks are lending. China and Japan are stimulating. Corporations are hiring. Unemployment is even lower than it was when the Fed started raising rates. Will it feel like a rerun of stage three, or will it be even more dramatic?

Fed members have not been willing to admit it, but common sense tells me that they will accept inflation between 2% and 3%. It could be six months or two years, but the Fed will get there. The sooner, the better (sooner is more likely). To reach the target, I see the following as possible:

- Wage growth should come down from 5% to a better long-term average of 3%, which means unemployment will probably have to rise to 5%.

- The Social Security Cost of Living Adjustment (COLA) of 8.7% will have to be lower in 2024.

- Corporate margins and earnings need to return to normal.

- The Fed will have to hold rates up while everyone gets used to normal. Consumers and corporations should not expect price increases in the double digits.

Stage VI: Return of the Stimuli (TBA)

Jerome Powell knows the best way to return to a healthy economy is to have stable and low inflation. He will return the order to American prices. Once he is certain he has done this, then he will rescue the economy from recession. He will not allow prices to fall, though. This deflation would remove an essential incentive for spending. If everything costs less in the future, then consumers postpone as much spending as possible. This phenomenon of the Great Depression will not be repeated. From 2008 to 2020, there was no limit to the stimulus (or stimuli) that the government gave to avoid deflation. It is likely a matter of time before the economic cycle gets back to a more prosperous stage.

I have lived through six economic recessions. Every one of them has been followed by a recovery.

What Happened

New inflation information is making headlines every week. Each time, investors adjust. We can call this speculation, pricing-in, or discounting of future events. Lately, all the information has shown rising prices entrenched in the current economy.

Last week, PCE, the Fed’s preferred inflation measure, was higher than expected. Not only that, but it also reached its highest level since June 2022. That was the month the Fed first moved rates up 0.75%. The Fed has a lot of work left to do. Investors reacted to the PCE report as would be expected. Bonds and stocks fell.

Where Are We Headed?

In my last commentary, I said that it was not worth taking much risk in the bond or stock market. This was true. Both moved down last week. I still do not believe it is a good time to take a lot of risk. In my opinion, the inflationary news of the last two weeks is too much for investors to ignore.

As I explained last week, consumers may be able to hold the economy up with their spending, but the money is coming from debt and savings. The latter removes money from financial instruments of all kinds. Banks continue to lend as borrowers currently qualify. The current banking issue is that rates are moving so fast that it is difficult to bid accurately for loans. That was a major problem in the Spring of 2022. Inflation was hot, and the Fed knew it could not ignore it.

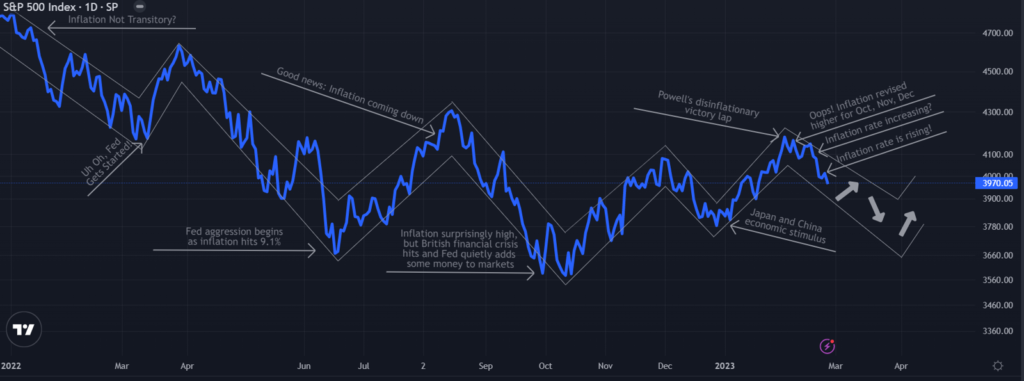

I see markets returning to a Spring 2022 environment as well. This can be seen in the accompanying graph. There is no way to accurately predict the path of the S&P 500, which I use to represent the U.S. stock market. Anything could happen in the coming days, weeks, and months. This week, I included brief notes from turning points in the last 14 months. Sometimes markets did exactly what you might expect. Other times, they did the opposite.

For now, the trend is down. Fundamentals are deteriorating. Markets are not quite oversold. Most market participants recognize this, so I expect we will go up and down for a while. In times like this, it is critical to have a plan. The plan, for now, continues to be light on risk. As an added bonus for being light on risk, short-term bonds, on average, are paying higher yields than at any time in the last 15 years.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.