Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

There is no such thing as a “No Economic Landing.”

For months, I have been emphasizing the possibility of a hard economic landing (recession) while downplaying the chances of a soft one. I also introduced, what I called, the “no landing.” This scenario has inflation staying up longer than anticipated because the economy is strong. Now that we are living the “no landing,” and people all over the country have just begun to use the catchphrase, I want to clarify. There is no such thing. The inflation airplane can only fly high for so long. Eventually, it must come down.

The Federal Reserve seems to think it won’t make the same mistakes as its members did in the 1970s. I believed them until they started to pat themselves on the back for a job well done. The fact is that 6.4% inflation is way too high, and, in my humble opinion, Fed Chair Jerome Powell should have been more careful with his words.

Powell’s optimism, combined with central bank liquidity subtly being added to markets over the last five months, has prevented inflation from coming down meaningfully. I continue to believe that inflation will not reach the target of 2% without more financial pain.

What Happened Last Week?

Revised inflation reports have single-handedly brought down the bond and stock markets. First, CPI was adjusted higher for November and December. Then January’s number barely showed any improvement, despite changes made by the government to only look back one year. The stock market took it all in stride. I considered this a relative victory considering the news. Bonds were not so fortunate.

Then came the Producer Price Index (PPI). This less-followed measure of prices shocked investors with its own higher revisions. This may have been the straw that broke the Wall Street bull’s back.

Why is inflation still so high? American consumers are spending. January retail spending was 3% higher than last year. That may not sound like much, but it is about as big as this number can get.

Consumer spending is 70% of GDP. A 3% increase is inflationary. A 3% decrease would be enough to cause a recession. Large purchases, like homes, may be down, but Americans have made few changes to their habits, and they probably won’t unless forced.

This brings me to credit card balances, which had a 16% increase last quarter—that’s the fastest and most significant increase ever. When you find yourself in a hole this large, it makes sense to put down the shovel and stop digging.

Education: Consumers Are Saving the Economy at the Expense of the Markets.

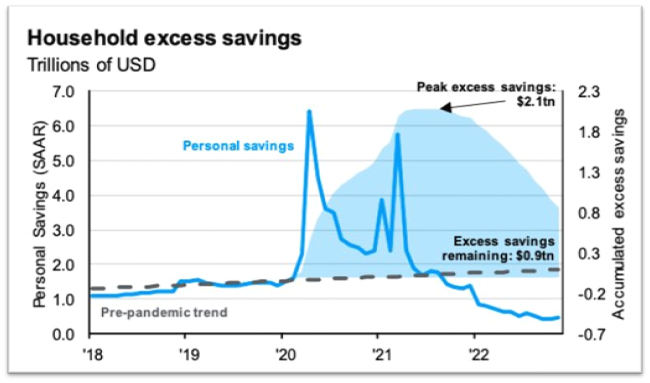

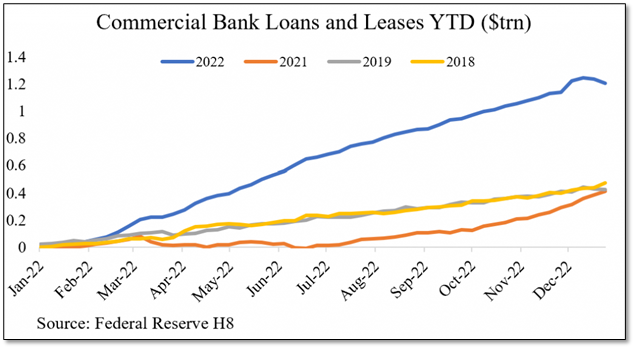

When consumers were receiving government money in 2020, much of it found its way into the stock market. We saw stocks go up in 2020 even while the economy was broken. Now, the economy is doing okay, but the flow of savings has reversed. Of the $2.1 trillion saved by Americans, there is around $800 billion left. As it is spent, it leaves financial markets to circulate in the economy. The current U.S. savings rate is the ugliest since 2005, which means less money is being added to markets. At the same time, debt levels are increasing at a record pace. This is a dangerous combination. Below, I have included charts to give some historical perspective on the savings rate, excess cash, and record bank lending. They illustrate well why the consumer and the economy appear to be okay.

Where Are We Headed?

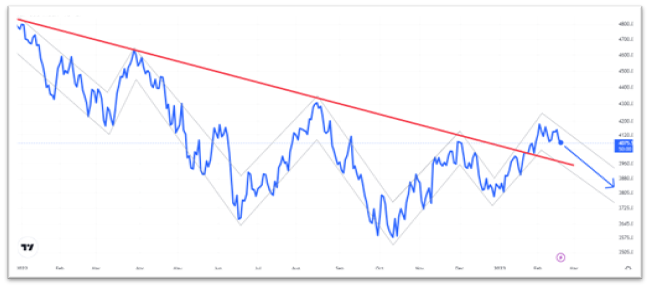

Central bank liquidity, strong consumer spending, and momentum have been holding up the stock market. It was holding up even when bad news came out. All that seemed to change last week. I believe that even though stocks could go higher, it is not a good time to take many risks.

Bonds are a different story. They moved up significantly in January, as a soft landing in the economy with low inflation was likely. That has proven to be false, and it is obvious now. Bonds reacted first, but stocks are likely to follow.

Few changes were made to my path. I had envisioned a possible jump to 4,250, but thanks to high inflation reports day after day after day, the window may have closed on it. Remember, this path is an educated guess to help create a perspective that considers probabilities as I currently see them. Anything could happen.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.