Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

Employment Is Doing Alright, for Now.

As I pointed out last week, employment is not a leading indicator, so it is not a good predictor for stocks. However, it is an incredibly important measurement of the economy’s health. In 2020, many employers let people go too quickly and could not find replacements. It is possible that many are acting in the opposite way. After all, it has been so difficult to hire. Why let people go?

Right now, we have mixed signals. Layoffs are increasing, but unemployment claims are still low, which means people are finding jobs for now. The number of job openings, known as the JOLTS report, is falling.

Last week, I talked about three scenarios (1) Soft Landing, (2) Hard Landing, and (3) No Landing. Two are likely bad for stocks, and two are likely bad for bonds. The Soft Landing means that inflation comes down while the economy is fine. It is the hope of every economist, and it always has been. Just look at these articles from December 2000 and September 2007.

What Happened Last Week?

The stock market is off to its best start since 2001. In case you don’t remember that time, here is a refresher. Stocks fell in 2000, especially tech stocks. Then came a huge bounce. The market even broke through several trend lines, which gave investors hope. However, it continued to find reasons to fall until it capitulated in late 2002 for a total loss of 55% in the S&P 500. This is what it looked like:

We just did something similar last week. We moved above a red line that had helped define the bear market of 2022. Sure, it could mean the bear market is over, but I doubt it. This market is fighting the Fed. That is one thing investors should be careful not to do.

Education: How Does the Fed’s Quantitative Easing and Tightening Work?

It is Fed week. Nearly everyone expects it to hike rates by 0.25% on Wednesday. Anything more would be bad news. The more interesting thing will be to try to understand the Fed’s intentions for future rate hikes and other efforts to slow the economy. If the Fed announces it is done, then stocks and bonds may rise. If the Fed is more cautious, then the opposite may occur.

While most people are focused on Fed rates, I want to dive into how the Fed’s Quantitative Tightening (QT) and Quantitative Easing (QE) work. We are going to dive deep into how these work.

It all began with QE. In 2008, when interest rates were close to zero, the Fed could have lowered them below zero. The European Central Bank did this. What a mess. Instead, the Fed began QE. It created money out of nowhere and purchased low-risk government bonds in the markets. Every buy has a sell. The seller let these bonds go at a price they thought fair and received cash. Of course, they didn’t want cash, so they invested it in something a little less safe.

Let’s create a hypothetical example. The Fed buys relatively safe government bonds, which pushes the seller to buy something more risky, like corporate bonds. The corporations that sold those bonds chose to take the proceeds to buy back their own stock. That means some investors sold the stock. They probably took the cash and speculated on riskier investments. The price of every asset in this chain has moved up in price, and every participant in the story is taking more risk than they were before the Fed got involved. This is QE, and it continued until the end of the first quarter of 2022.

QT is the exact opposite of QE. The Fed sells relatively safe assets, and a buyer is likely to step down in risk to purchase what the Fed sells. And it continues, causing a drop in all asset prices. This is what happened for much of 2022 and is expected to continue until the Fed gets reserves down around 10% of GDP. What are reserves? Many astute investors would love to ask the Fed that question this week.

Where Are We Headed?

“Earnings don’t move the overall market; it’s the Federal Reserve Board. Focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.” –Stanley Druckenmiller

Liquidity is one of my market indicators. It is made up of bank lending and the creation of money by the Federal Reserve. Banks must have reserves and the willingness to lend. In 2008, they needed more reserves. In the decade that followed, there was a lack of demand. Right now, they are lending despite rising risks.

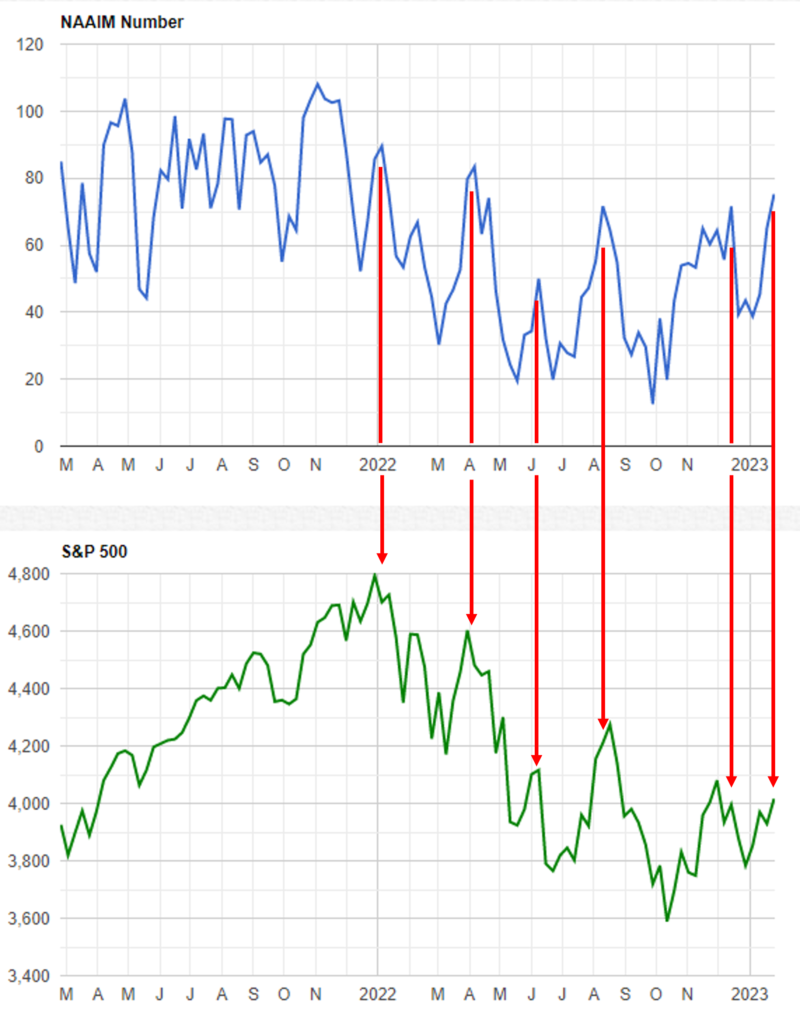

I measure liquidity by focusing on the Fed’s balance sheet. Surprisingly, it was rising as we entered the year. It has now come down two weeks in a row, which does not look good for stocks. Overall, no changes to the outlook. There is a chance stocks move higher, but I believe they are getting over-extended.

We could move lower for at least a couple of weeks. I will change my mind if the Fed announces a pause to interest rate hikes immediately or if Jerome Powell announces that the Fed is discussing an end to rate hikes and an end to QT. I think this would send stocks, bonds, and inflation higher. I suspect Powell will give a more measured tone where he recognizes progress but continues to be concerned.

My sentiment indicator is also flashing major warning signs. We have covered that in detail in a previous commentary, and I’ll share it in future weeks. For now, I expect a difficult and choppy market to continue with incredible swings in all directions. As you study this chart, remember anything can happen, and this is only an educated guess.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.