Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

Soft Landings Are Difficult, and It’s Getting Crowded.

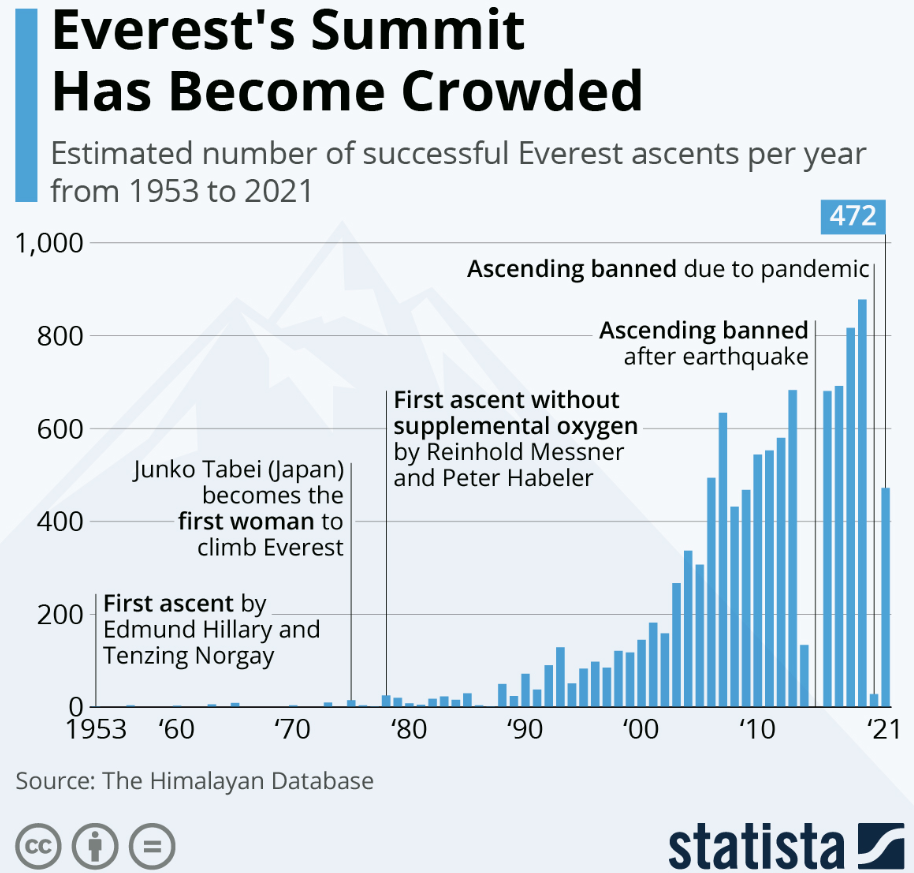

Flying is one of the safest ways to travel, but some landings are easier than others. Lukla Airport in Nepal was rated the most dangerous in the world (History Channel). It is the most popular airport for those climbing Mount Everest in the Himalayan Mountains at an elevation of 9,325 feet above sea level. At one end of the runway is a mountain wall, and on the other, a 2,000-foot drop into the valley below. Complicating matters more; it’s getting busy in the Himalayas.

The immense number of climbers is creating gridlock on Everest. The waiting periods are more than frustrating, and they can be dangerous. A slow climb increases the risks of dehydration, exhaustion, and even death. In May 2019, 11 people died. It is important to recognize that 99.9% of climbers survive. However, the risks are significant and increase as the mountain gets more crowded.

Wall Street is overcrowded with bulls right now. If they start looking for a flight out, markets will become financially precarious.

The Federal Reserve (Fed) is trying for a soft landing at a challenging destination. History has proven that bringing down inflation permanently without causing a recession is something nearly impossible. The last time the Fed tried was in the 1970s and early 1980s. A recession still came, and inflation still wasn’t dead. We had three rounds of inflation and four recessions in 12 years. I imagine the Fed had intelligent people back then, just as we do today. Soft landings are tricky.

What Happened Last Week?

In the last week, major indices bounced all around. Some ended up. Others were down. The same can be said about bonds. Here is a list of some fascinating events this week. I’ll let you decide whether this behavior is likely to continue or reverse. My opinion comes later in this commentary.

- Retail sales unexpectedly dropped 1.1% in December – stocks fell over the following 2 days.

- Over the last 10 days, Bed Bath & Beyond announced it was closing 130 stores, preparing for bankruptcy, and being removed from the NASDAQ stock exchange – the stock moved up 400% but then lost half those gains.

- Alphabet (Google) announced it would lay off 12,000 workers – its stock rose over 5% that day.

- Microsoft announced it would lay off 10,000 workers – its stock fell 2% that day.

- Netflix reported that over the last year, its earnings dropped from $1.33 per share to just $0.12 – the stock immediately jumped up 7%.

Education: Scenario Analysis

So, we have three things to consider. (1) Can we get a soft landing? (2) Is a soft landing already “priced in” to the market? (3) How are we going to invest profitably? In the end, it is the last one that matters most. Let’s focus there.

I see markets at a crossroads. Inflation is coming down and the Fed wants to make sure it gets down close to 2% and stays there. Its members say that it will raise interest rates by at least another 0.5% -taking the rate to 5%. They also unanimously say that they have no plans to lower rates this year. It seems some investors do not believe the Fed.

Scenario 1: Soft Landing

All news is good news as long as inflation comes down quickly enough that unemployment does not rise significantly and the housing slowdown never spreads to other sectors. The Fed would not raise rates because inflation is low, and it does not lower rates because the economy is fine. Stocks might be okay. Bonds struggle because investors expect rates to come down.

Scenario 2: Hard Landing

Inflation comes down, but it is too late for consumers. They are pulling back on spending. The economy slows. Unemployment rises. Eventually, the Fed decides that inflation is not a concern (this would take some time or some huge changes in the numbers). The Fed lowers rates. Bond investors get what they want. Stocks struggle as many investors have never seen a time when there is a recession without the Fed bailing them out immediately.

Scenario 3: No Landing

Suppose inflation drops, but not low enough. For example, inflation could fall to 5% and stop there. This would take some time to see but would be a major concern to the Fed. It would have to start raising rates again. This would likely return us to a 2022 environment that was poor for stocks and bonds. Commodities, like oil, did well.

Which Scenario Do Markets Favor Now?

Bonds are pointing to scenario 2. The bond market is off to a strong start in 2023. It’s doing even better than stocks so far. Investors are pricing in that the Fed will lower rates by 2%–starting in the 4th quarter of this year.

Stocks have been volatile but positive in January. This supports scenario 1. Inflation is falling. Unemployment is still near its low of 3.5%. The Fed has no reason to be too aggressive. Interest rates should hold steady, which is exactly what the Fed plans to do.

Once Americans embrace an overly optimistic attitude towards investing and spending, only financial pain will teach them moderation. I have heard it said that each generation needs to learn the lessons of recession. Since the last major recession was 15 years ago, many young adults have yet to experience its struggles or learn its lessons.

Where Are We Headed?

In 2022, we moved from too much optimism to too much pessimism. We repeated that pattern several times. Already in 2023, I see a reason to plan for something different-a market without a clear direction. Stocks are trying to balance a deterioration of fundamentals with a stoic hope for a return to “easy money.”

I believe every generation needs to learn lessons, and most people must learn them through personal experience. The last major recession was 15 years ago, which means there are many young adults that have yet to experience the hard times that come from a major downturn. Plus, the Fed rescued us from that one. It has been nearly 50 years since we faced inflation.

So, people continue to do what they have learned. Many buy aggressively whenever they can. No one is planning on hard times—even among most professionals. That means, in the short-run, markets want to go up. That is how it feels to me.

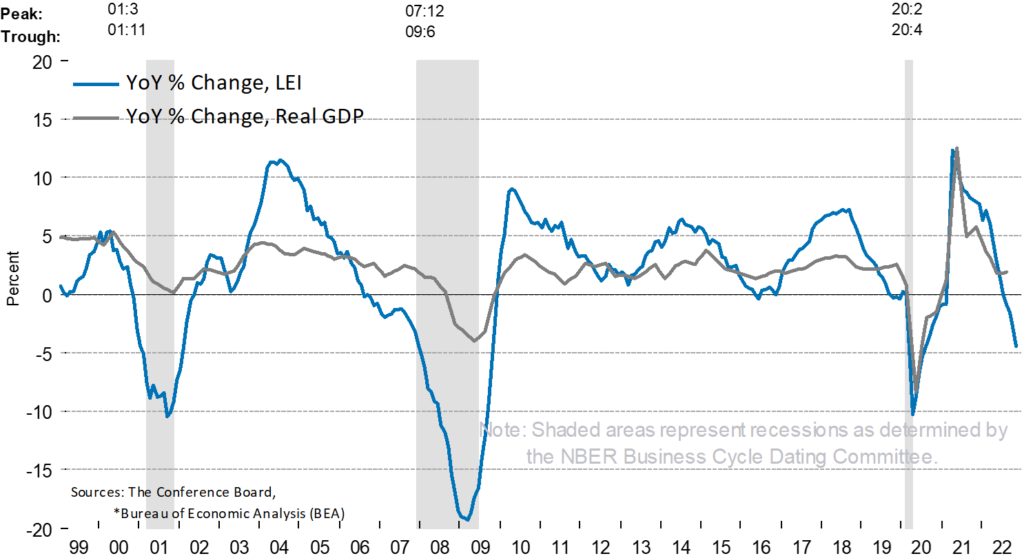

Investors are embracing the best of all three scenarios. Stocks are up. Bonds are up. Commodities are up. In a time when the Fed is trying to engineer a slowdown, I do not believe this will last. However, anything can happen over the coming days and weeks. Eventually, I expect the stock market will be forced to acknowledge the truth. The Conference Board runs the most prominent economic indicators. It organizes them by leading, coincident, and lagging. A good example of lagging is employment. By the time we see a deterioration in employment, the recession will already be upon us. The Leading Economic Indicators (LEI) are the most important to investors. They can be seen dropping in the blue line below. The chart implies that GDP is likely to follow.

When the blue line declines, a recession (grey-shaded area) follows. It is declining. Here is how Ataman Ozyildirim, Senior Director, Economics at The Conference Board, described the latest number:

“Only stock prices contributed positively to the US LEI in November. Labor market, manufacturing, and housing indicators all weakened—reflecting serious headwinds to economic growth. Interest rate spread and manufacturing new orders components were essentially unchanged in November, confirming a lack of economic growth momentum in the near term.”

My outlook can be seen below. Remember, it is an educated guess. Anything could happen. Even if it is partly correct, the market has a way of deceptively moving from day to day.

Finally, we have the debt ceiling, which I am ignoring for now. If extraordinary measures get us to June, then I don’t think the politicians will feel the urgency for some time. A downgrade of the U.S. debt rating would hurt as some pensions may be forced to sell. However, I don’t have any way of knowing how likely this is. I, like many investors, will be ignoring it until the time gets closer.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.