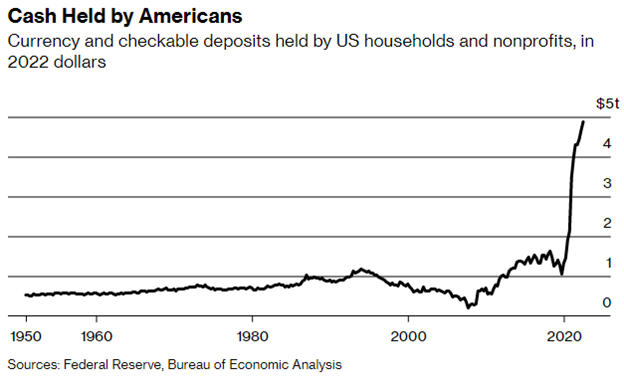

At the end of 2019, Americans held around $1 trillion in savings—not a small sum. The economy at that time was $21 trillion. That means Americans were earning roughly $21 trillion per year. Then came the pandemic, and everything changed.

The Federal government began depositing stimulus money in a magnitude this country had never seen before. The Federal Reserve began buying assets in the financial markets to push up prices. The operations were a sum roughly 10 times greater than what was done in 2008-2009, and it was spent ten times faster.

In the decade preceding the recession of 2008, the savings rate was under 5%. After that recession, Americans became a bit more cautious and increased the percentage saved to 7%. In April 2020, the percentage of income saved reached over 30%. Apart from a few more stimulus-induced spikes, it has gradually slowed.

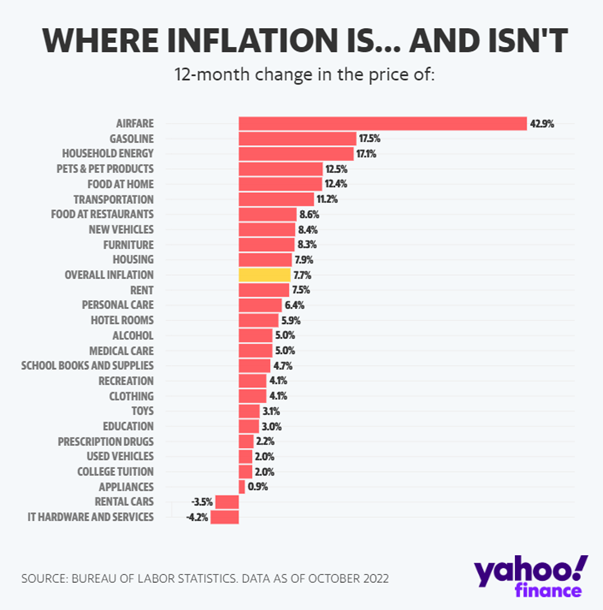

The excess money created a demand that outpaced the supply of goods available. This caused shortages of cars, appliances, etc. Next came price increases. According to the Consumer Price Index (CPI), the rate of inflation increased almost every month from May 2020 (0.2%) to June 2022 (9.1%). Since June, the rate of increase has come down. The current rate is 7.7%.

There are a lot of inflation measurements and a lot of ways to slice it up. For example, “glass-half-full” people like to point out that inflation is close to zero if you take out food, energy, gasoline, and housing. That may be significant. However, it would mean more if we didn’t have to pay for food, energy, gasoline, and housing costs. Instead of getting lost in those weeds, see the details in the graphic above. It includes a breakdown of where inflation is high and low.

These high prices, combined with higher interest rates, have lowered the savings rate to just 3.3%. This is the lowest level since the 4th quarter of 2007.

That brings us back to where we started. In total, Americans have a lot of cash still. It is why consumer spending is still high and economic growth is still positive. It is the reason that unemployment is not a significant problem. Employment is the reason that home prices have not collapsed. Despite all of the issues in the world, the U.S. economy is doing alright for now.

Listen to a deep dive into how Americans are doing on the Power Up Wealth podcast.

One Comment