Only One Could Lead to Long-term Economic Prosperity

There is a saying in economics that the solution to high prices is high prices. This works in two ways that overlap: supply and demand.

Supply: As prices rise, producers want more products to sell in order to make more money. The increase in supply creates extra. Then prices come down to entice buyers.

Demand: As prices rise, consumers may choose not to buy, which encourages sellers to lower their prices.

If prices come down eventually on their own, why does the Federal Reserve (Fed) raise and lower interest rates? Because once an upward (or downward) movement gets started, historically, they have been incredibly painful. If the Fed gets things right, it smoothes out the cycles.

In 2020 and 2021, when the government was doing its best to stimulate economic growth, the Fed believed that high prices were temporary and would solve themselves, and they have not, and the Fed is nervous.

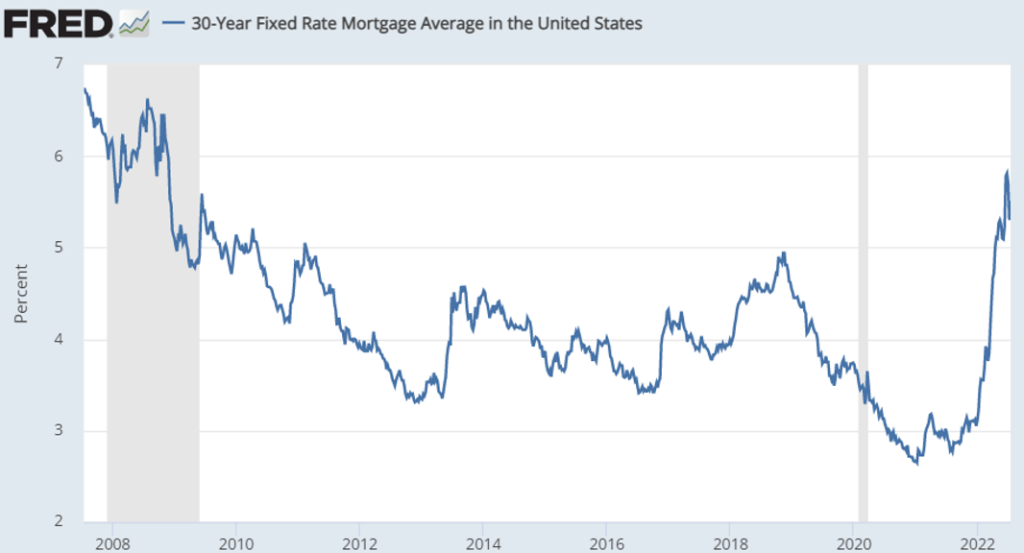

Now, the Fed is determined to stop inflation. It has all the tools it needs. By increasing rates, the Fed will increase the cost to borrow and bring down spending, especially in areas sensitive to borrowing (housing).

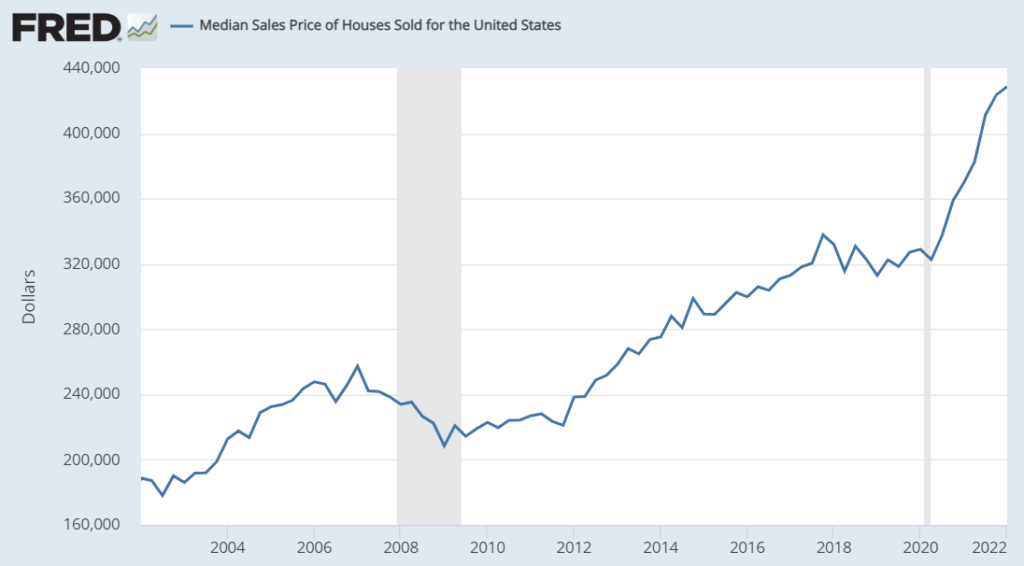

The 30-year fixed rate is still low compared to October 1981, when it was over 18%. However, low rates in recent years have increased affordability, which has allowed home values to move higher. Now, affordability has never been worse.

A mortgage payment is based on the borrowed amount, the time horizon, and the interest rate. If the rate goes up and the time horizon doesn’t increase, the borrowed amount must come down. This is where we are likely headed: If inflation doesn’t come down soon, we may see home values decline substantially.

I believe we have already reached that tipping point where people are beginning to change their behavior. The Fed needs to make sure and will continue raising rates.

It is all part of a cycle we have seen many times before. Ultimately, we really want a balance of supply and demand. Even if it causes some short-term pain, the economy will grow better with low inflation.