Thursday, May 16, 2024, ended an incredibly positive streak in the stock market. The market was positive for 12 of the last 13 days. A positive streak like this has only happened twice in the previous 20 years (March 2010 and December 2019). It is evidence that there is a lot of money in the economy looking for a home.

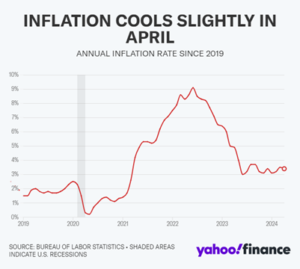

Once again, investors are excited about the possibility that inflation is coming down, which would allow the Federal Reserve to lower interest rates. We have seen this excitement in the bond market a few times in the last two years. Each time, investors eventually realized that they had become overzealous. I’ll let you be the judge. Are we coming down, or does it look sticky?

The best hope for inflation is a slowdown in the economy. With inflation at 3.4%, consumer spending would grow by approximately 3.4% (or more if consumers are in a generous mood). This is not what is happening. Consumer spending, which represents 70% of the economy, is weakening. Total retail sales were unchanged last month.

Consumers should spend a little less.

Consumers have been saving significantly less and taking out more debt. Debt-driven economic growth is real, but it is also fragile. This break from spending growth is a good sign for the country’s long-term health.

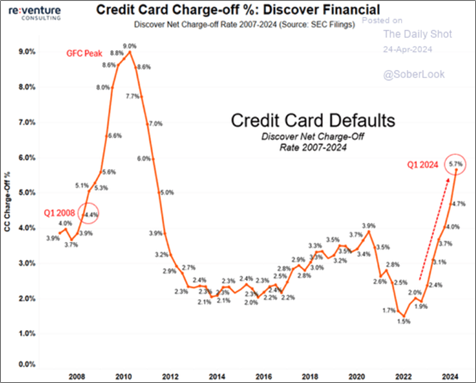

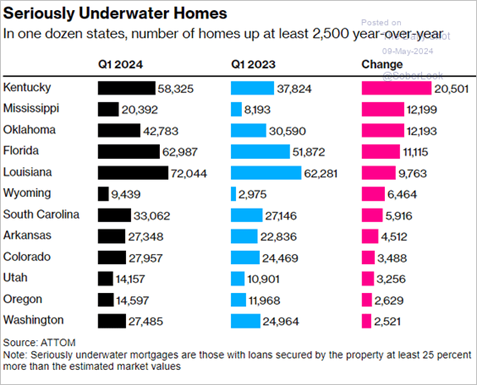

I am watching three things to gauge the health of the American consumer.

- Employment: Still strong—The rise in unemployment is so small it is difficult to see.

- Credit card payment delinquency: Rising fast.

- Home values: Near highs but showing some cracks.

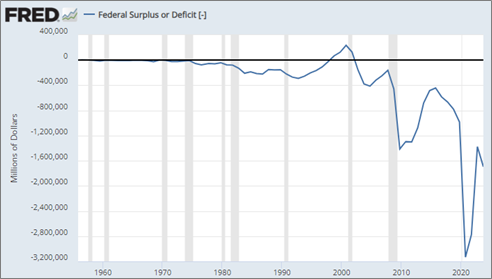

The U.S. government is supporting inflation.

The federal government continues to spend as if we are in a recession. While Americans may have complained about government debt for decades, something new is happening.

Rather than blame politicians, citizens would be better served by looking in the mirror. It seems we are no longer even pretending to care. We cut taxes and increase spending. We rescue ourselves from hardship in the bad times and continue to keep it going even in the good times. The result is not government bankruptcy. That is the least likely scenario. The result of overspending will be—inflation. The proof is in the pudding.

Keeping up with inflation is goal number one for savings. Investment accounts are an excellent way to do this. As Uncle Sam continually bumps up the money supply, we not only get inflation in goods and services, but we also see an impact on financial assets. After all, the money gets spent and spent until it eventually finds its way into the accounts of the savers. One would think that all this government stimulus would slow after the election, but who really knows for sure?

Stay invested.

The combination of stocks and bonds has done well in the last year. Stocks are expensive but an okay choice IF inflation goes even higher. However, if inflation continues to rise, then higher interest rates should finally slow down the consumer and cause the economy to slow. This will finally kill inflation. It should also bring down corporate profitability and send stocks lower. The Fed will then lower rates, and bonds will be the best place to be. This makes stocks more attractive. So, bonds and stocks will be attractive again. In other words, the entire system is run to help assets and investments rise over time with the supply of money from the government. This is why we always emphasize the importance of staying invested for the long term.

Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not.

Anything can happen in the stock market.