Medicare open enrollment is right around the corner. If you are already using a Medigap Plan or a Medicare Advantage Plan, now is the time to make a change if you want. The open enrollment period is October 15th through December 7th every year.

Who needs to pay attention?

Those currently using a Medigap Plan, Medicare Advantage Plan, prescription drug plan, or if during your initial enrollment period, you opted not to purchase additional coverage up and above traditional Medicare Parts A & B.

What is Medicare?

Traditional Medicare is composed of three parts: A, B, and D. Part A is coverage for hospitals and doesn’t have monthly premiums. Part B is coverage for doctor visits, etc. and the base cost is $135.50 per month for most people. This typically comes out of your monthly Social Security check. Part D is prescription drug coverage, which is purchased through a third party and costs around $35 per month.

What is the difference between a Medigap and Medicare Advantage Plan?

Medigap is a supplemental insurance that complements traditional Medicare. It covers most of the “gaps” or holes that are not covered by parts A & B. You can go to any doctor that accepts Medicare.

Medicare Advantage Plans combine Parts A, B, D, and Medigap into one package. They operate like traditional insurance where you are tied to a specific network.

What else should I know about Medigap?

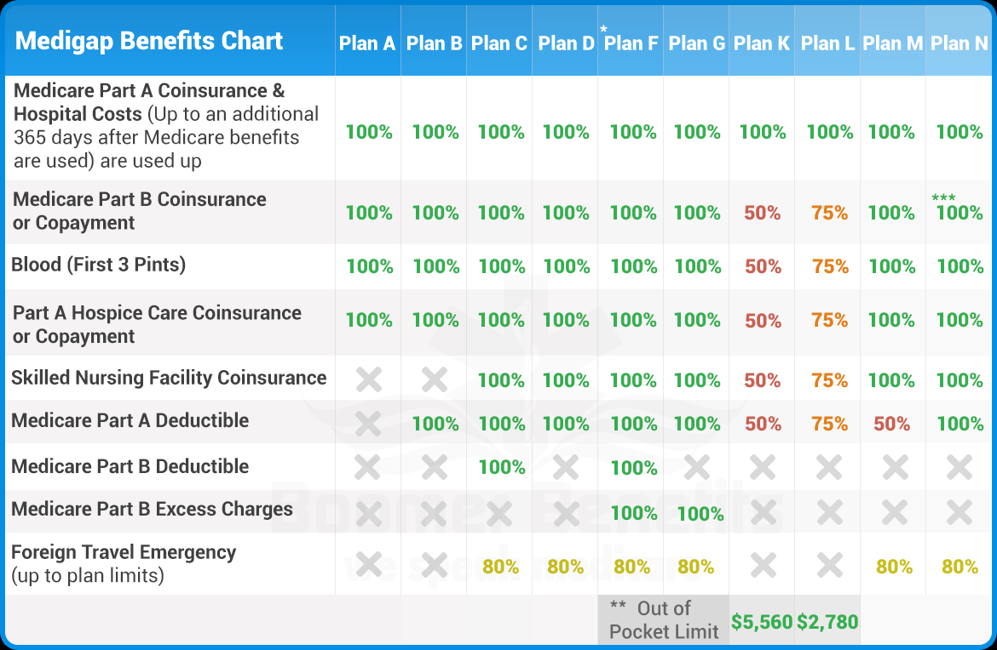

Medigap Plans are lettered from A-N with costs that vary depending on the benefits provided. The most popular plan has been F. However, Plans F and C are being phased out in 2020 as plans are no longer allowed to cover the Part B deductible of $185. If you are currently on one of those plans, you can stay on it, but new enrollees will have to choose a different plan. Plan G is gaining in popularity because it covers everything Plan F covers, except for the Part B deductible. In many instances, the Plan G costs are lower and can be a better value than Plan F anyway.

People that have comprehensive Medigap Plans typically pay more on a monthly basis, but usually don’t have to pay very much out of pocket. If your health is ok to poor and you see a doctor regularly, then this may be a good option for you.

What else should I know about Medicare Advantage plans?

Medicare Advantage Plans, also called Part C, will often cost less than Medigap Plans. It typically has deductibles and co-insurance like traditional insurance through an employer. How it works is Medicare gives an insurance provider a certain amount per year to manage your expenses. If the insurance provider manages your expenses for less, then they make money. Because of that, monthly costs vary significantly with some plans as low as $0 per month.

People that use Medicare Advantage Plans usually pay less monthly, but typically have more out of pocket expenses. If you are in good health and don’t regularly see a doctor, then this may be a good option for you.

What resources could help me research my options?

The website www.medicare.gov has a plethora of information. You can use it to sign up for Medicare or any of its Parts A, B, C, or D. You can also find contact information for Medigap providers. If you would like to speak to a person, you can call 1-800-Medicare (1-800-633-4227).