Imagine planning on a 7 percent average annual return on your investment, getting it, and still running out of money in retirement. Unfortunately, this happens to many investors without proper planning and smart investing. Why? The order of when the positive and negative years in the market occur can be devastating or rewarding—we call this the sequence of returns.

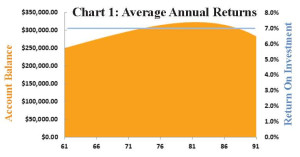

Average annual returns are often used when projecting future outcomes in retirement planning. For instance, you may project that during your retirement years your investment accounts will average a 7 percent annual return.

Chart 1 illustrates how an account would perform assuming a 7 percent average annual return. As you can see, the picture looks very promising. You may believe that after 30 years, you would have more money than when you started. Actual market volatility can deliver a much different result.

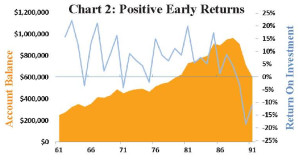

The next two charts paint an entirely different picture. In both cases, the average return is still 7 percent. Chart 2 shows the impact of positive returns in the early years of retirement–the type of scenario experienced by those who began retirement around March of 2009.

For many years, even though there may be day-to-day volatility, investors would experience positive returns. This could allow an account to grow even with consistent withdrawals.

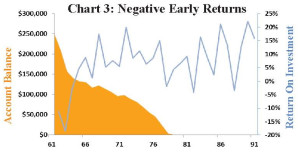

But what if you retired at the beginning of a financial crisis? This happened to many people that retired in the fall of 2007.

Taking distributions from a shrinking account can deplete a nest egg earlier than expected. Chart 3 shows the impact of negative returns in the early years of retirement. As you can imagine, this type of scenario can be financially devastating.

Most retirees cannot afford a market landslide as they begin retirement. It may require them to reduce their standard of living or delay retirement.

Lifetime Income Planning addresses the sequence of return issues and many other critical retirement planning concerns. Let us help you design a plan to help protect you. Call today to receive a free brochure or to speak with one of our wealth consultants: 800-748-4788.