The U.S. housing market is hot and home prices are going through the roof. This is due to a growing economy. Utah is especially impacted by Silicon Slope companies that are bringing in a lot of high-paying tech jobs; i.e. high demand compared to supply.

With home prices continuously increasing, people are questioning if this is the right time to buy a home or if they should wait for a time when the housing market cools off.

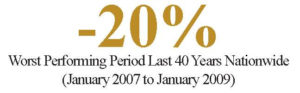

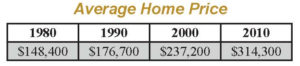

There are always ebbs and flows to the economy and markets, including the housing market. Many people remember all too well the housing collapse that we had in 2008, even though that was a decade ago.

We don’t expect another housing collapse like that one in the next few years, but we do expect the overall market to soften up. Maybe we will have a smaller recession in 1-3 years. When that recession happens, housing prices will come down. The question for potential home buyers is, “How far will they come down?”

If housing prices in the area you are looking do become cheaper than they are now, then you may be better off to wait. This is a probability, but there is a chance that even though house prices decrease at that time, they will still be higher than they are today.

The other piece of the equation that many people frequently forget to consider is interest rates.

A 1 percent move in interest rates means you can afford roughly 89 percent of the home you could before. If you were looking at $400,000 homes before, now you can only afford to buy a $356,000 home for the same monthly payment.

The Federal Reserve has indicated that they plan to raise the fed funds target interest rate by 0.25% several more times this year and in 2019 as well. These are short-term rates, but they will impact the longer-term rates that determine your mortgage interest and payment.

We have been at historically low-interest rates for the last decade and once that ship sails I don’t expect to see interest rates this low for a very long time. However, an economic slowdown could bring rates lower again.

If you are moving, at least you have the increase on your existing home to help offset the increase on the home you are buying, unless you are moving from a depressed area to a hot area.

If you are buying for the first time and plan to stay longer than 3 years, now might be the right time to buy just to lock in low-interest rates. However, you still need to seriously consider your financial situation and whether you can afford the home you want. Don’t jump into something that is too much money just because you feel the pressure to get a deal done. Know your limits and be willing to back out if the deal gets too hot.

Renting may feel like you are throwing your money away, but it also provides flexibility. If you only do it for a few years you won’t be that far behind financially. In a few years, you may even be in a better financial situation. Who knows? You might be able to buy a home at a cheaper price than you can today.

Renting may feel like you are throwing your money away, but it also provides flexibility. If you only do it for a few years you won’t be that far behind financially. In a few years, you may even be in a better financial situation. Who knows? You might be able to buy a home at a cheaper price than you can today.

********************

Payment calculation based on a 30 year mortgage, loan of $400,000, principal and interest payment of $1,961 and interest rate of 4.25% vs. 5.25%. Data in graphics and tables from Federal Reserve Bank of St Louis.