In 1913, the 16th Amendment to the Constitution, in an effort to fund a war, made the income tax a permanent fixture in the U.S. tax system. The amendment gave Congress legal authority to tax income and resulted in a revenue law that taxed incomes of both individuals and corporations.

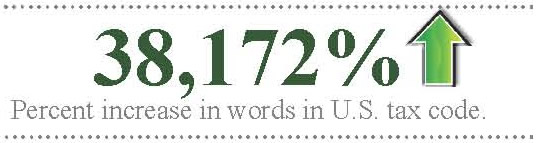

Over the last one hundred years the tax code has become much more complicated. The number of words in the first tax law was 9,337. In 2010, the number was 3,800,000. Our leaders have obviously been busy!

To further complicate a complex system, the Senate waited until January 1, 2013 to pass a tax law that affects every American in some way. Here’s a recap of what to expect.

Affecting the majority of working Americans.

The elimination of the temporary payroll tax cut means you will take home a smaller paycheck. The payroll tax cut reduced the employee portion of the Social Security tax to 4.2 percent in 2011 and 2012. This year the employee portion reverts back to 6.2 percent. A worker earning $50,000 can expect to take home $1,000 less

in 2013.

Affecting the wealthy.

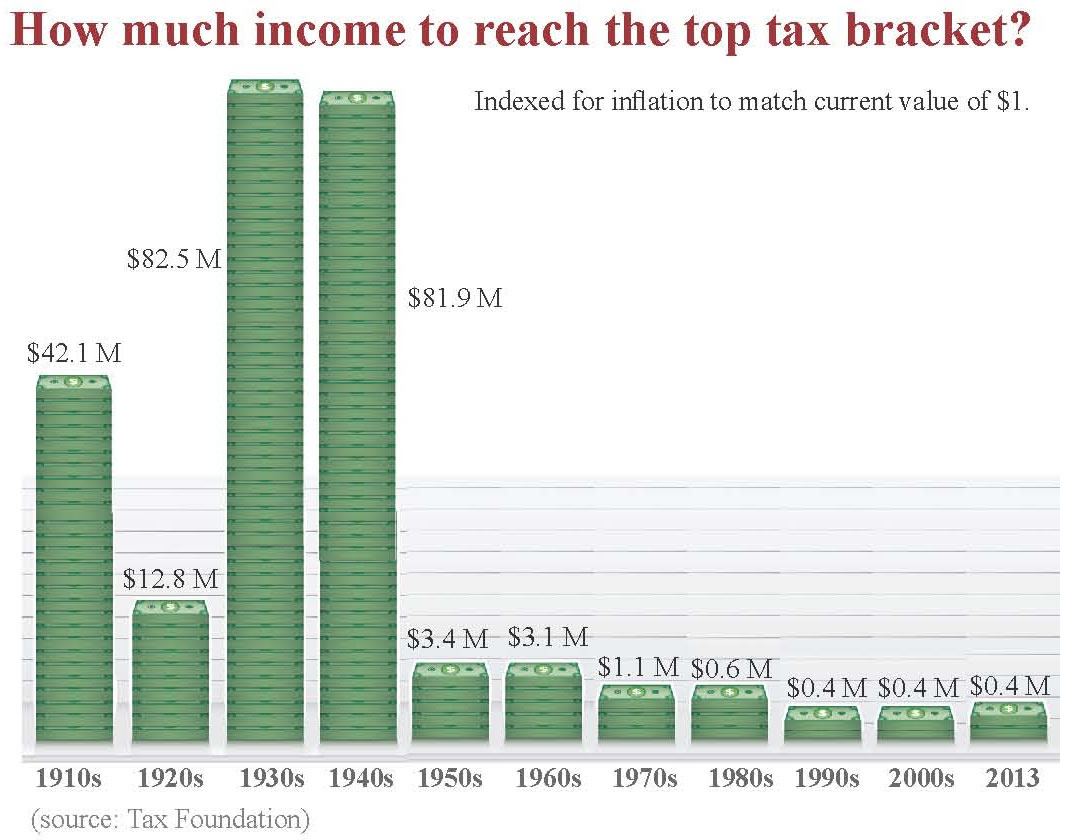

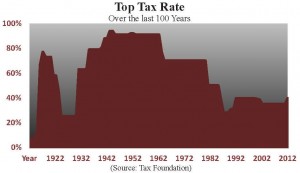

If you are fortunate enough to have a taxable income greater than $450,000 (or single filers above $400,000) you can expect a higher marginal income-tax rate. The top marginal income-tax bracket has increased to 39.6 percent. Previously the highest bracket was 35 percent. These same filers will also pay more in capital gains taxes. The top capital gains rate has increased to 23.8 percent. This is up from last year’s 15 percent.

The wealthy are hit again on deductions. Those making more than $300,000 ($250,000 for single filers) will see their deductions and personal exemptions phased out. On a positive note, the Alternative Minimum Tax (AMT) threshold will now be adjusted for inflation.

The Alternative Minimum Tax was originally designed to make sure wealthy Americans were not using loopholes to avoid paying taxes. AMT knocks out a lot of exemptions, deductions, and credits forcing those affected to pay a minimum amount of tax. Previously the law was not automatically updated for inflation and every year more and more Americans were being hit by this limiting tax.

Estates over $5 million can expect to pay 40 percent in estate taxes. Last year the estate tax rate was 35 percent. This is of course after the $5 million Estate Tax Exemption.

Some good news.

The child tax credit has been extended. This is a great benefit to families with children and can mean up to $1,000 in tax credits.

Unemployed workers will continue to receive benefits.

Contribution limits.

There are few ways for wage earners to reduce their tax liability. One way to help now and when it comes to retirement is making contributions into qualified retirement plans. If you have a company sponsored retirement plan such as a 401(k) or 403(b) you can make a maximum contribution of $17,500 in 2013. If you are 50 years or older, you can make an additional contribution of $5,500.

Traditional IRA and Roth IRA contributions have also increased this year. You can make a maximum contribution of $5,500. Those over 50 can make an additional contribution of $500.

It took a great deal of political posturing and arguing for our elected officials to come to agreement on this recent tax law. Let’s hope they are more open minded and courageous when it comes to what may be this country’s greatest hurdle—reducing spending. This is only a short recap of the recent tax changes. Please contact our office for additional information or to discuss your individual situation.